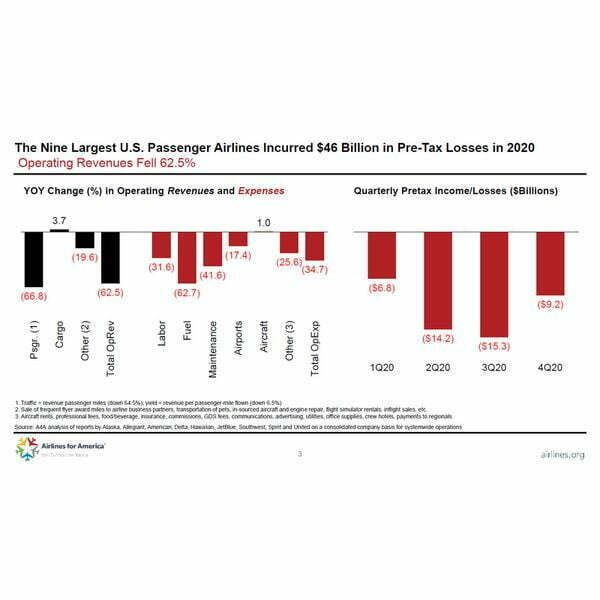

U.S. passenger airlines incurred pre-tax losses of $46 billion in 2020 and $35 billion in net losses, according to Airlines for America (A4A), the trade group representing U.S. commercial carriers. A4A noted that air cargo demand reached an all-time high in 3Q 2020.

The “A4A: Airline Industry Review & Outlook” concluded that air-travel demand remains severely depressed but could pick up meaningfully as vaccination rates increase and travel restrictions are loosened.

The report said airlines have taken on billions in debt as net interest expense doubled from 2019 to 2020 and will exceed $15 billing in 2021-2023.

“As an industry, U.S. airline cash burn will continue through most of 2021,” the report said. “It will take years for airlines to retire the newly accumulated billions of dollars of debt. The sizable associated interest expense will limit their wherewithal to rehire and reinvest.”

The report also cited statistics from Airlines Reporting Corporation that corporate air travel continues to struggle, with recent months off 82.8 percent from 2019 levels, but that overall travel agency bookings have started a slow recovery and are now down 56.4 percent in recent months.

A4A said the industry was unlikely to return to 2019 passenger volumes before 2023-2024, adding the next few years are clouded by uncertainty. The optimistic outlook is that better-than-expected vaccine efficacy, accelerating rates of vaccination worldwide, fewer travel restrictions, better-than-expected economic outlook/stimulus and a business and personal travel resurgence could mean a faster commercial aviation recovery.

The A4A also suggested the possibility of a more bearish outlook, with vaccines failing to address new strains of COVID, low rates of vaccine deployment or acceptance, the maintenance of travel restrictions, and a faltering global economic recovery combining with a permanent change in how companies view the necessity of business travel to keep passenger volumes lower beyond 2023-2024.